Precis:

The new year came in with a bang as bitcoin tickled the $42k level and ETH reaching for 1.3k. Now is the perfect time to review our last yearly plan, recount the past years major news events and plan for the next. In our last yearly report we outlined how we thought 2020 would be largely side-ways but would end on new highs. We outlined how defi would be a defining feature of the year. And here we are, the foothills of a bull-market. Crossing the Rubicon. Shifting the paradigm. Toward a great reset. Bretton Woods 2.0.

Buckle up – This time it is different.

This is quite a large article, so to make it easier to skim I’ve included a table of contents and below that outlined which sections are predominantly recounting, recapping, summarizing or looking forward.

Contents:

- How this all started

- Government & Institutional Interest in crypto

- Bitcoin Evangelism of Fund Managers & Traditional Investors

- Price Predictions

- Traditional Markets

- Out of Control Money Supply

- Models & Heuristics

- Bitcoins progress

- Altcoin Trends

- Macro price formation scenarios

- Potential Exit Strategies

- Conclusion

Section 1 is a brief history of bitcoin

Sections 2 – 7 recap the progress of bitcoin in 2020

Section 8 ‘Bitcoins progress’ summaries sections 1 – 7

Sections 9 – 12 Are our plans for managing our portfolio going forward

How this all started

The Times 03/Jan/2009 Chancellor on brink of second bailout for banks. This was the message contained in the genesis block of bitcoin by Satoshi Nakamoto himself. And the message is still as resonant today, 12 years later as it ever was. The financial system is unsustainable and corrupt.

Satoshi released bitcoin to the world the same day the Times article was published and after taking suggestions for improvements from the community and allowing them to work directly on the code he handed over control to Gavin Andresen, leaving bitcoin forever.

Satoshi stated he left the project to focus on other things, never moving his known stash of bitcoin, never revealing himself. Remaining anonymous has been a powerful catalyst for his project, it has made way for true decentralization, allowed others

Now the institutions are looking for shelter from the storm they have created, and bitcoin is checking their boxes. Bitcoin, once a refuge for WikiLeaks when their payments provider cut them off. Once the primary currency of the SilkRoad the deep-web black-market. No doubt these aspects of bitcoin were not part of his plan but perversely they helped cement security in the idea that people could actually transmit bitcoin and receive goods or services. I remember seeing silk road for the first time, and although I was astonished people could sell drugs online, the more staggering thing to me was they used a decentralised pseudonymous e-currency to settle payments with escrow and such. And it worked.

Satoshi (whoever he is) had impeccable timing, the 4 year cycles, fixed supply, its like he’s still playing 4D chess against the banks and he’s winning. Bitcoin and crypto will swallow the worlds assets classes one by one, slowly at first, then all at once.

Government & Institutional Interest

Intro:

Miami Treasury:

After a suggestion from Anthony Pompliano on Twitter that Miami Mayor Francisco Suarez should move 1% of Miami’s reserves to BTC. Suarez said on twitter in response to Pompliano.

“Definitely open to exploring it.”

When asked if Miami would also consider accepting bitcoin as a means for citizens to settle their bills & taxes with the city, Suarez confirmed it was on the cards.

“We are definitely going to be working on that in 2021.”

If you ask us, this is huge, being able to settle bills with bitcoin in yet another place shows it is becoming ‘real’ money.

MicroStrategy Inc:

Ruffer Investments Co Ltd:

In November 2020 UK based Ruffer Investments Co Ltd bought $744m of bitcoin, its currently worth VALUE. Ruffer, who have £20.3 billion under management as of 30 November 2020, said the investment was “primarily a protective move for portfolios” to “act as a hedge” against “some of the risks that we see in a fragile monetary system and distorted financial markets.” The key takeaway from this statement shouldn’t be, wow they are buying Bitcoin, it should be, wow Ruffer see the monetary system and markets as fragile and distorted.

SkyBridge Capital:

Blackrock:

Yes that’s right BlackRock, the largest asset manager in the world, with more than $7 trillion in AUM (assets under management), Is advertising a position of VP Blockchain Lead. The investment professional will create and implement BlackRock’s crypto-asset strategies.

Details of the job posted on the company’s website specify that, the candidate must have experience in distributed network consensus mechanisms, technical knowledge of cryptographic hash functions, public-private key cryptography. As well as a good knowledge of valuation methodologies for crypto-assets and the ability to evaluate game theory.

An excerpt from the ad reads

“The candidate must have 1 year of experience in articulating the technological foundations of blockchain technology including cryptographic hash functions, devising and articulating fundamental valuation methodologies for crypto-assets, evaluating game theory and decentralizing governance models associated with blockchain technology, and working with key drivers of blockchain networks’ design and their impact on the four key dimensions of blockchain performance including speed, scalability, privacy and security,”

Larry Fink, CEO of BlackRock has spoken optimistically regarding Bitcoin and other cryptocurrency assets in recent statements. During a conversation with former Bank of England Governor, Mark Carney at the Council on Foreign Relations, Fink mentioned that Bitcoin has gained the attention of Wall Street and the world’s largest cryptocurrency has the potential to evolve into a global market asset. Fink stated

“Bitcoin has caught the attention and the imagination of many people. Still untested, pretty small market relative to other markets. These big giants move every day, it’s a thin market. Can it evolve into a global market? Possibly,”

The recent job vacancy advertised by BlackRock shows that the company is not only optimistic about Bitcoin and other cryptocurrency assets, but it is planning to introduce crypto-related services soon.

Citibank:

A leaked report from Wall Street giant Citibank has revealed a senior analyst thinks bitcoin could potentially hit a high of $318,000 by December 2021, calling it “21st century gold.”

JP Morgan:

JPMorgan Chase & Co have recently stated that the rise of cryptocurrencies in mainstream finance is coming at the expense of gold. Money has poured into Bitcoin funds and out of gold since October.

GRAPHIC – BITCOIN V GOLD CHART

A trend that’s only going to continue in the long run as more institutional investors take a position in cryptocurrencies, according to the bank’s quantitative strategists. JPMorgan is one of the few Wall Street banks that’s publicly predicting a major shift in gold and crypto markets as digital currencies become increasingly popular as an asset class.

JPMorgan’s calculations suggest Bitcoin only accounts for 0.18% of family office assets, compared with 3.3% for gold ETFs. Tilting the needle from gold to bitcoin would represent the transfer of billions in cash.

“The adoption of bitcoin by institutional investors has only begun, while for gold its adoption by institutional investors is very advanced,” wrote the JPMorgan strategists.

JPMorgan also said that in the short term, there’s a good chance that Bitcoin prices have overshot and gold is due for a recovery. They say this will happen due to Bitcoin, as momentum signals have deteriorated, which will likely cause selling by investors that trade on price trends.

Grayscale:

Digital asset manager Grayscale the ‘Bitcoin blackhole’ are currently buying almost 3x the supply of bitcoin being mined, this as well as ferocious efforts at buying from other large institutions is leading to the current supply crisis.

Grayscale has passed another milestone, reaching $22.8 billion in assets under management (AUM) on Jan 4th, up from the $19 billion announced last week.

PayPal:

PayPal have announced they are launching a crypto remittance & payment service where you can buy/sell and transfer multiple cryptos within their platform. Users of PayPal will not be able to transfer their crypto to their own wallets or off of the PayPal platform. But users will be able to use their crypto to pay any PayPal merchant, however PayPal will instantly convert the crypto to fiat on behalf of the merchant. We expect that at some point in the next year merchants will demand the choice to be able to accept crypto payments, rather than fiat conversions, through PayPal.

https://www.paypal.com/us/smarthelp/article/cryptocurrency-on-paypal-faq-faq4398

Sub-Conclusion:

All of these businesses have been buying bitcoin for a variety of reasons, PayPal is buying so it can be shuffled around their closed ecosystem, Ruffer are buying as a hedge against market uncertainty. Grayscale are buying three times the supply of bitcoin being mined and locking it into their closed system forever.

The size of the buys, the quantity of buyers, closed systems capturing of bitcoin, its all lead to a staggering supply crisis never before seen in assets. Real demand for real scarcity from large well-managed entities trying to protect their wealth.

Traditional Investor Interest:

Michael Saylor:

Michael Saylor has become the new ‘bitcoin Jesus’. Not only has he converted his companies capital reserves to bitcoin but he has taken out debt to the tune of $650m to buy even more. Absolute mad-lad. But his balls-out approach has already paid off.

INSERT MICROSTRATEGY PERFORMANCE

Raul Pal:

Raul Pal is the CEO and Co-founder of real vision capital and a seasoned and successful macro investor. He specializes in trading the big picture. Recently Pal said, based on the current technical momentum of Bitcoin and the market sentiment around it, precious metal investors could “flip to BTC.” – in line with JPMorgans sentiment on the BTC and precious metals.

Pal also said

“Bitcoin is eating the world… It has become a supermassive black hole that is sucking in everything around it and destroying it. This narrative is only going to grow over the next 18 months. You see, gold is breaking down versus bitcoin…and gold investors will flip to BTC”

“Bitcoin’s performance is SO dominant and SO all-encompassing that it is going to suck in every single asset narrative dry and spit it out. Never before in my career have I seen a trade so dominant that holding any other assets makes almost no sense”

“The supermassive black hole is going to suck in everything. Again, this is the best trade/investment and future opportunity I have EVER found and it has the power to give the little guy a chance to grab their share of the wealth creation before Wall Street does.”

“Grab it,” Pal noted.

Stan Druckenmiller:

This billionaire was charged with curating George Soros’ fortune in the 1990s. And it is said he didn’t have a down year in his entire career but this statement is hard to verify.

He recently told CNBC that although he is a BTC buyer, he owns “many, many more times gold than he owns bitcoin.” But (and there is an important, but!), he added, “Frankly if the gold bet works, the bitcoin bet will probably work better,” opining that BTC is more illiquid and has more beta

Anthony Scaramucci:

Anthony Scaramucci, founder of skybridge capital, former comms director for trump and ex Goldman Sachs employee.

Scaramucci has recently been warning that bitcoin is due a pullback but remains staunchly bullish. His firm skybridge capital also recently launched a bitcoin fund similar to that of grayscale.

Paul Tudor Jones:

The founder and chief investment officer of Tudor Investment Corporation.

He stated he only holds a “small single-digit” BTC stake, but reserves plenty of praise for the token. Last month, he said, “I think we are in the first inning of bitcoin and it’s got a long way to go,” and said that crypto is “like investing with Steve Jobs and Apple or investing in Google early.” Also, his fund seemingly invested around USD 210m in BTC.

Bill Miller:

Miller is the founder and chief investment officer of investment firm Miller Value Partners

He claims to have bought tokens back when you could snap them up for just USD 300 each. Back in 2018, he stated that bitcoin is “much more transportable than gold” and “can actually be used to buy things.” In November this week, he said that BTC’s “staying power gets better every day.”

Mark Mobious:

An ex-World Bank advisor, Templeton Emerging Markets Group’s former executive chairman. Otherwise known as the “Pied Piper of emerging markets”. He is also the founder of the asset management firm Mobious Capital Partners.

Mobious says BTC is the real deal, however he doesn’t actually own any. Last year he stated that bitcoin embodied “a desire among people around the world to be able to transfer money easily and confidentially”. Later adding that if BTC continues to grow, he would consider buying.

Fred Wilson:

Co-founder and managing partner of union square ventures.

says both he and his firm are in the crypto investment game for the long haul. “Bitcoin is our digital gold,” he said last year. Back in September last year, he wrote “I am long crypto and USV is long crypto. And we are putting more capital into the sector and will continue to do so.”

Alan Howard:

Billionaire British hedge fund manager & co-founder of Brevan Howard Asset Management.

His firm, Elwood Asset Management, last year announced it was building a new crypto investment platform for institutional investors, claiming that it had identified some 50 crypto hedge funds that “probably satisfy” the company’s due diligence protocols.

Chamath Palihapitiya:

Virgin Galactic Chairman & CEO of Social Capital

is as bullish as they come when it comes to BTC. Not only can you pay him and his associates in bitcoin if you want to take part in his company’s soon-to-be-launched sub-orbital space flight program, he also speaks about bitcoin is glowing terms – calling it “gold 2.0.” Palihapitiya stated earlier this year that BTC was on course to “create a quasi gold standard” for the digital age.

Elon Musk:

Elon Musk, former CEO of dogecoin and edge-lord on twitter, has a stance on crypto that has been hard to put a finger on but in recent posts on the platform his position has become clear.

Obviously Elon is in favour of crypto assets, probably holds some. But I imagine after his history he is fairly scared of backlash from regulators and that’s why he is staying fairly ambiguous in his commentary.

Sub-conclusion:

It has become clear to us that the ‘bitcoin virus’ is spreading into hedge-fund offices, treasuries, maybe even mars. With such levels of confidence, interest and awe coming from these economic figureheads, the differences between this bull run and both preceding it are plain to see. But its not just bitcoin that’s different this time, it’s the traditional markets too.

Money Supply:

We published an article in the middle of 2020 called $100 Million Per Minute. It detailed the relentless money printing of the fed, who said at the time they can print ‘endless’ amounts of money. 20% of all dollars in circulation where printed in 2020 that’s more than was printed in the past 20 years combined. We have fallen over the precipice, there is no un-printing this money, no amount of ‘quantitative tightening that can fix this. The Money in your pocket will lose its value by inflation when they print more. The value of your assets will plummet when they sell off assets on their balance sheets.

That is why the largest financial institutions have been calling for Bretton Woods 2.0, essentially a reset of the eurodollar hegemony.

Traditional Markets & Macro Economics:

The traditional markets are on the ropes. Investors don’t know how to value stocks anymore as the price and value of performant-stocks are diverging. Companies that aren’t generating profits are seeing incredible gains, gains that are completely disjointed from performance. Leading many macro-fund managers to look toward safe havens assets like bitcoin

Price Predictions:

Anthony Pompliano:

Anthony Pompliano is a well-known Bitcoin personality. He’s a founder and partner at Morgan Creek Digital, a crypto-friendly asset management firm for institutional investors. He has previously claimed that he holds more than 50% of his net worth in Bitcoin, showing his belief in the cryptocurrency.

Pompliano has predicted that Bitcoin will hit $100,000 by the end of December 2021. At the time of the prediction (February 2020), Bitcoin had just reached the $10,000 mark, meaning the currency would need a 1,000% increase — within just two years — to reach his target. His prediction would put the market cap of Bitcoin at more than $2 trillion.

Mark Yusko:

Mark Yusko is the billionaire investor and Founder of Morgan Creek Capital.

His prediction for Bitcoin is that it’ll be worth over $400,000 in the long term, a statement that made headlines because for its grandiose scale.

“It’s just math. It is gold equivalent…there are about 20 million Bitcoin available today. Gold today is about $8 trillion. That gives you $400,000. And that doesn’t include use cases that relate to currency,” Yusko said.

He also pointed out that the asset is striking fear into the hearts of bankers, precisely because Bitcoin eliminates the need for banks. When transactions are verified on a Blockchain, banks become obsolete.

JPMorgan:

JPMorgan said in a in a recent note

“While we cannot exclude the possibility that the current speculative mania will propagate further, pushing the bitcoin price up towards the consensus region of between $50 – $100k, we believe that such price levels would prove unsustainable”.

Tyler Winklevoss:

Tyler Winklevoss, the co-founder, and CEO of the crypto exchange Gemini and one of the earliest BTC adopters believes that Ethereum’s price is a “steal” now. He noted that the second-largest cryptocurrency is still about 50% away from its all-time high.

Willy Woo:

Willy Woo, one of the most popular cryptocurrency analysts, reiterated his bullish sentiment. In a recent tweet, he asserted that bitcoin will not drop below $20,000. In fact, he believes that only a black swan event, similarly to the COVID-19-prompted dump in mid-March, would drive BTC beneath the support level at $24,000.

Metrics, Models & Heuristics:

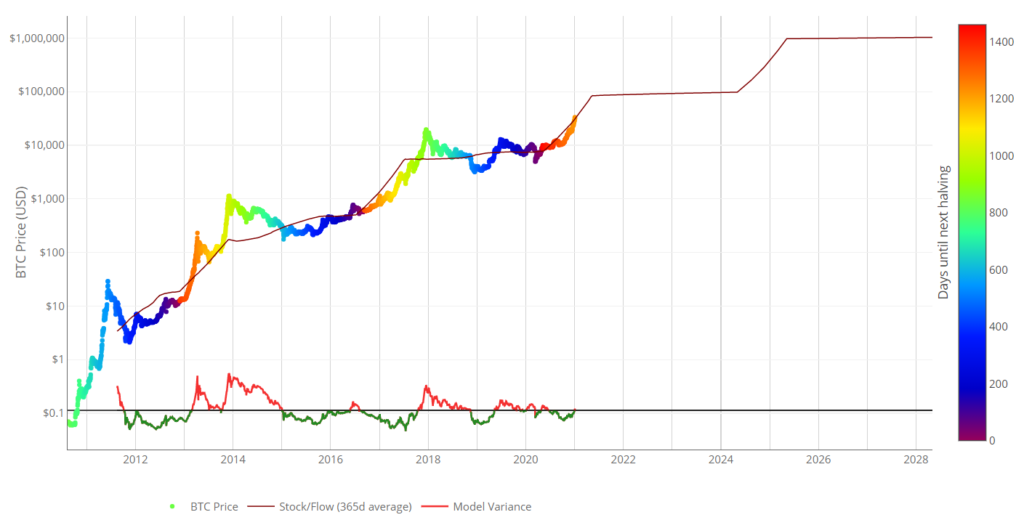

Stock to flow:

The stock to flow model is right on track, putting us on target for well over $100,000 possibly up to $500,000 at the peak with $100,000 setting up to be the rough floor in price through the next bear market.

,

The rainbow coloring of the price represents the days until the next halving, and to us, the chart that has formed looks strikingly similar to the same period from the first the 4 year cycle.

Hash Rate:

Hash rate is about to surpass all-time highs and isn’t likely to stop anytime soon. The supply shortage coupled with the amount of new mining farms being set up across the world has the momentum to keep hash-rate trending upward at a steady pace.

Sub-conclusion:

All of bitcoins largest timescale indicators are still very much bullish. Zooming into the 20 Week MA, rsi on the weekly shows bitcoin could do with a breather. But that not a given, Bitcoin could easily ‘climb the wall’ and pop to 50,000 before a re-trace occurs.

Bitcoins Progress:

With institutions coming into the fold – this time it is different – they will bring torrents of capital. Retail fomo will come but it will only affect the altcoins, not the bitcoin market.

The symbiosis between conventional financial firms & service providers will strengthen bitcoin and cryptos position to become un-touchable. As pension funds and the rest buy in it will become too risky for governments to even consider banning crypto. In fact today the office of the comptroller for the united states has provided guidance for all US banks to be able to use stable coins. Removing the USD tether risk (one of the largest potential black-swan events) from the crypto markets.

I think it is highly likely that we will see bouts of massive growth and then stability rather than the 30-40% drops of yesteryear the aforementioned torrent of liquidity on the horizon and the traditional mindset will combine to form a ‘sponge’ that will soak up dips faster than usual.

Bitcoin is literally eating the world, here is a list of currencies bitcoin overtook in terms of market cap in 2020 https://twitter.com/DocumentBitcoin/status/1344708131528568840?s=20

Altcoin Trends:

Defi:

Defi will become a household name within the next 10 years, just as bitcoin is now. And will become more prolific than retail banking. It only serves those that use crypto currently but eventually it will be the new backend of modern finance.

Insurance:

Multiple insurance protocols will be required for the ecosystem to function in a similar manner to traditional markets. With multiple crypto-insurance providers covering each other as well as .

NFTs:

NFTs will be a small market until blockchain and big gaming are properly integrated. There are some titles on steam that use blockchain at the moment but nothing with enough clout to bring it to the masses yet unfortunately.

Block

Oracles:

Multiple oracle providers will be essential in maintaining decentralization of data ‘gatekeepers’. We also need many approaches in this space to bring about competition and progress. Therefore Chainlink will not be the only billion dollar market cap oracle provider by the end of the year.

Scaling:

Anything scaling related will be huge until the full launch of ETH 2.0 especially if that project integrates with Ethereum, has a working product and Dapps. Good examples of this would be xDai and Polkadot.

Decentralisation:

Decentralization will be a huge topic going forward. Questions are currently being asked about whether large corporations, such as Google and Facebook, that act as ‘gatekeepers’ of the internet should be broken up. The mentality of decentralization and data sovereignty is creeping through modern culture. Slowly at first.

Macro price formation scenarios:

We see one of two main scenarios playing out – either bitcoin moves up in two parabolic moves with small 10% dips throughout and consolidation for a few months between the moves. Or we move up in one large steady parabolic run with up to 30% pullbacks on the way

~30% Dips:

If ~30% dips form this is the best case scenario for the retail investor as those dips present the best buying opportunity for you and the recovery from them is typically inter-month. It would also give more defined cycles to altcoin runs.

~10% Dips:

If only ~10% dips form in the upward trend this will take buyers slightly off, guard leading to a larger blow-off top at the end of the bull run.

Exit Strategies:

Timing your exit will be hard to plan for, but what you are going to do with the money is a little easier. To profit though the next bear market we plan to split our portfolio into multiple bear market hedges.

Shorting the market:

This one will be tough to time but lucrative in the end, reallocating a portion of your portfolio to a short on bitcoin at its headiest heights could yield thousands of percent gains. And would properly hedge any bitcoin you had riding. Using an inverse perpetual contract would allow you to make those gains in bitcoin, which could be held or used to flip long up the next cycle peak in 2025.

Yield Farming:

Re-allocating a portion of your portfolio to USDC or other yield farming coins that wont loose value for 2 or 3 years using it to yield farm on various platforms. Yield farming can generate up to and over 200% APR on your deposits. Stable coins and low liquidity tokens tend to make the most gains using this method. We will be publishing a yield farming guide in the coming months.

The Gold Play:

At the end of this bull market smaller more savvy investors will be looking for somewhere to move at-least a portion of their wealth out of bitcoin, or even all crypto. This will lead to rises in the price of gold and the like, as well as select stocks. If you think this is likely, allocating a portion of your portfolio to a gold stable coin would be a good idea.

Mining or Node Equipment:

Buying something like this doesn’t come lightly, there is a large initial investment to buy the device and running costs. But if you want to proactively generate income in this ecosystem, running a node is one of the laziest but most fulfilling ways. Once the device has been running for long enough it will pay off the initial investment and the energy bill for what it took to generate the money to pay the initial investment off.

NFTs:

The NFT market is still in its infancy and wont have come drastically further by the end of 2021 however it may be possible to preserve wealth or maybe even profit on re-allocating a portion of your portfolio to some kind of NFT, whether it be land in Decentraland, collectibles, or maybe even art. Its worth monitoring over 2021 to check if this would be viable for the proceeding 2 – 3 years

Stonks:

Probably not the best idea, but who knows, might be a short term run on them January of 2022, barring some black swan event.

Starting your own crypto project:

This one is far less passive than the rest. You need to be motivated and have a good team, no matter what size, that believes your project can make a real difference. You need to plan well in advance and proper knowledge of regulation or red tape that may affect your business. Starting your own crypto business does have some upsides, there is a whole world of ideas and needs out there, you will be able to solve a real world problem and deliver value to your users. Hopefully you could convert it to a DAO and the whole crypto ecosystem will continue to grow as you do.

Glossary of terms:

Eurodollar:

The term Eurodollar refers to U.S. dollar-denominated deposits at foreign banks or at the overseas branches of American banks. Because they are held outside the United States, Eurodollars are not subject to regulation by the Federal Reserve Board, including reserve requirements.

Hegemony:

Leadership or dominance, especially by one state or social group over others.

Full Disclosure:

At the time of writing I hold these bags:

Bitcoin

Ethereum

Chainlink

Uniswap

1 Inch

AAVE

Ren

Synthetix

Balancer

Compound

Elrond

Polkastarter

Vechain

The Graph

Bondly

API3

Kusama

Curve Dao

Swiss Borg

Enjin

Energy Web

UniBright

Injective

Akropolis

Xdai

Cosmos

Ankr

Cream Finance

Ocean Protocol

Iexec RLC

Maker

Kyber

Etherisk

Cover

Nsure Network

SpiderDAO