Market Stats:

Tokens: LEND, REN, COMP, SNX, CEL, KNC

Usage: Lending, DEXs, Derivatives, Payments, Assets

TLDR:

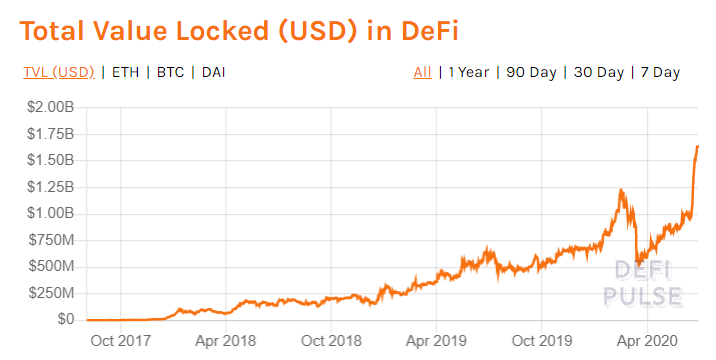

Over the past few weeks defi has experienced a surge of capital inflow with the total value locked into it reaching all-time-highs ($1.65bn). Surpassing the previous highs of February this year ($1.25bn). Lending platforms have by-far taken the lead in terms of growth, with $1.25bn of value locked at the time of writing. Largely stimulated by popular platforms like compound and balancer listing their network tokens, on large exchanges such as Coinbase and FTX (respectively).

This market behavior is reminiscent of the 2017 ICO bull run, and could be mistaken for a pump and dump style event. If you take into account factors like supply, price discovery & liquidity, its clear this is more than just an empty pump.

It’s the birth of a new finance system. This is exhibited best by the current shift of sentiment in the crypto market at large among old-school professional fund managers and large firms, yet some of the most bullish and knowledgeable among them on crypto have no idea of defis existence. You wanted to get on at the ground floor? Here it is.

Of course, it is not without risk. This kind of opportunity must be properly risk managed and in this article I will further outline risk management in the defi space.

Capital Inflow

As shown above, the amount of capital being locked up with defi projects is at all time highs. Its looking quite likely that the market will be able to either maintain these levels or push higher. Another supporting metric, the defi market cap, has been rising to unprecedented levels. In less than a month it has increased 3x, going from just under $2bn to over $6bn.

Supply & Liquidity

Supply has been an important factor as to why some defi tokens ran harder than others, it is basic supply and demand economics, when the supply of a token is low, each unit of the token is more scarce than a comparative asset with high supply.

The only way to acquire many of these defi tokens up until recently has been to earn them using the respective defi platform and earning them as interest. Keeping circulating supplies low.

Price Discovery:

Again, until recently real market price discovery hadn’t taken place for most defi tokens. The fact defi platforms currently have very few users means that when their token launches on an exchange, the circulating supply will be low, thus increasing upward momentum. When the token enters a free market such as an exchange with these characteristics a price run is inevitable. As more people use the defi networks, they will earn tokens out of the supply, adding them to the circulating supply, in turn the volumes will rise eventually stabilizing the markets. Now the larger defi projects are listed for trading expect wild volatility as investors seek gains.

Sentiment:

The Crypto market at-large is poised for an enormous bull run. The sentiment for bitcoin and crypto among professional traders, fund managers and old money is shifting toward a deeply bullish stance. Investors such as Peter Thiel are publicly announcing their interest and allocation in bitcoin. That does not mean a large drop in bitcoins price before the next run up is off the table. Absolutely not.

However this overall shift in sentiment could (and most likely will) catalyze the ‘2020 defi boom’ into something much larger. This is further cemented as likely because of some recent interviews in which huge players in the crypto/bitcoin space have been caught off-guard when asked about defi responding that they ‘didn’t know what it was’.

Defi Sectors:

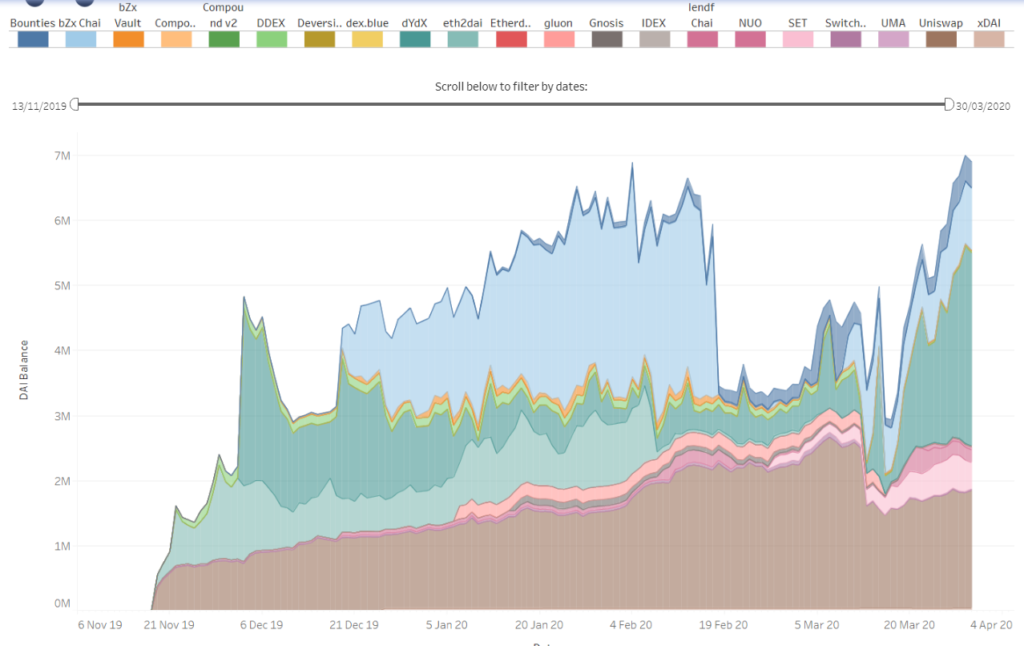

Although the spike in growth of value-locked across the different sectors of defi have happened in unison, lending platforms have definitely taken the lead with total value locked in lending making up just over 75% of the total $1.65bn ( £1.25bn). The below graph demonstrates how dominant the lending sector is when compared to the first graph in this article.

Defi vs Open finance:

Defi really comes in two flavors, decentralised finance and open finance. The latter often being mistaken for the former as it is used as a blanket term for both. Open finance uses the frameworks of old-finance (i.e. centralised leadership) to achieve the same goals as defi. Both types have their pros and cons and neither is more suited to what it does purely based on whether it is open or decentralised nor is one innately more risky than the other. Both can deliver the same products to the user but each will have different risk exposures.

Open finance projects have not had the same kind of capital inflow as the fully decentralised projects This could be interpreted as the market voting with its money that a fully decentralised approach is putting the right foot forward, fortunately its far too early to draw any conclusions yet.

Conclusion

Fortunately its not quite moon time yet. Whilst the total value flow into the defi market is still low relative to more traditional finance markets or even other crypto markets, it is proportional to the current risk associated with defi platforms. Every platform is in its testing stages at the moment, being debugged by real users with real cash. But, in my opinion the low relative inflow and the risks only highlight a considerable opportunity.

Great Defi Metrics:

Coming soon – How to yield farm