This is a list of resources we use to research the market as a whole as well as evaluate particular projects and how they can best help guide you through the crypto forest. Skip to the last section for a guide on how to dyor which covers assessing your needs, selecting an asset or market type and selecting which set of tools to use.

Web & Desktop Tools

Reddit – Bleeding edge altcoin opinions

Reddit has always been and still is the central place for bleeding edge altcoin discussions. This is where all the youtubers and news websites go to find out what people on the ground are excited or concerned about. Although it is a forest of outspoken opinion, if you weed through it you will likely be able to front run most community driven pumps. Most of the defi projects have been spoken about at length on reddit months in advance of people writing about them in news outlets or youtubers making videos about them.

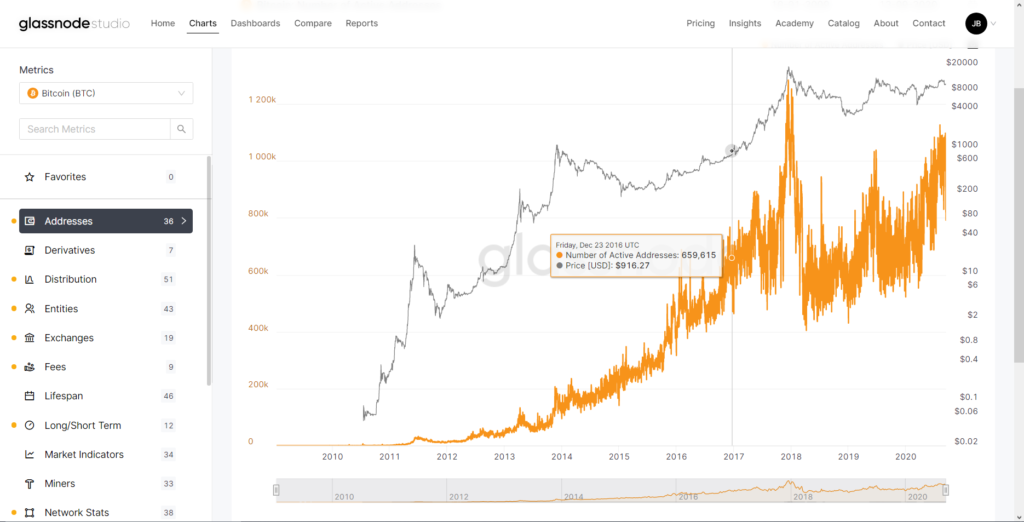

Glassnode – On-chain data & market data

Glass node has an incredible suite of metrics that really help on longer timeframes. You need to create an account to access their dashboard but it’s well worth the 2 mins it takes. There are paid plans but the data provided in these plans are not of any real use to the average retail trader.

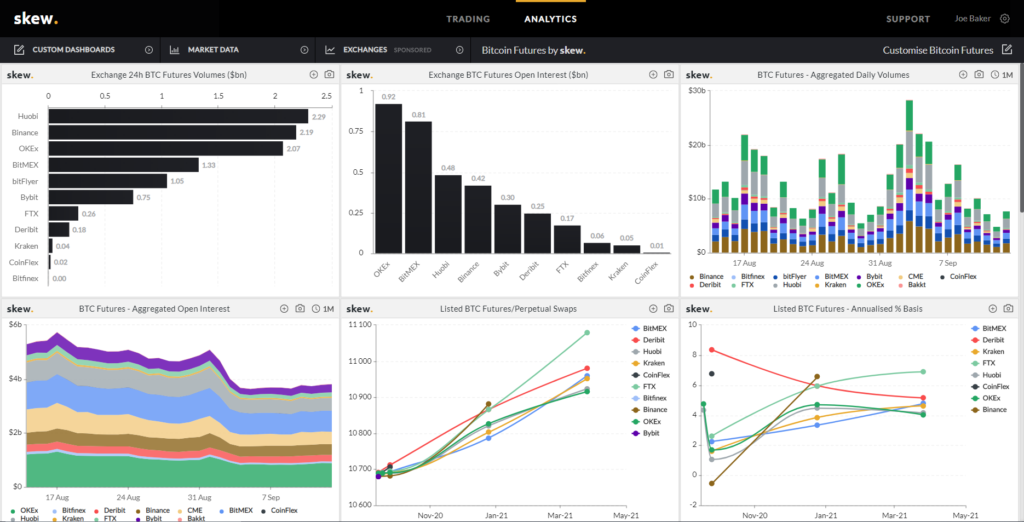

Skew – Futures market data

Skew has a plethora of indicators for futures exchange data, graphing open interest, liquidations. It has a slick customizable interface allowing you to drag and drop indicators into groups and resize them based on your needs.

Scalpex – Futures market data

Scalpex is like the crypto fear and greed index that only applies to bitcoin and its futures markets. It has many more indicators than the CFGI, for example, market order flow, open interest, liquidations and hidden orders

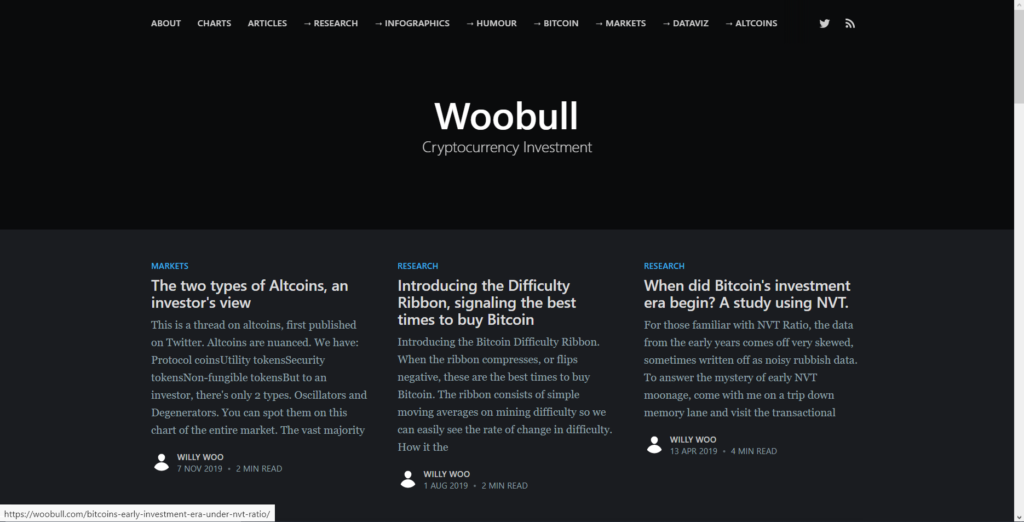

Woobull – Specialized graphs of bitcoin on-chain data

Willy Woo creates custom metrics to help better define the movements of the market and find swing tops and bottoms over the largest timeframes. Woobull.com is where he publishes not only his charts but well informed blog posts on modern economics.

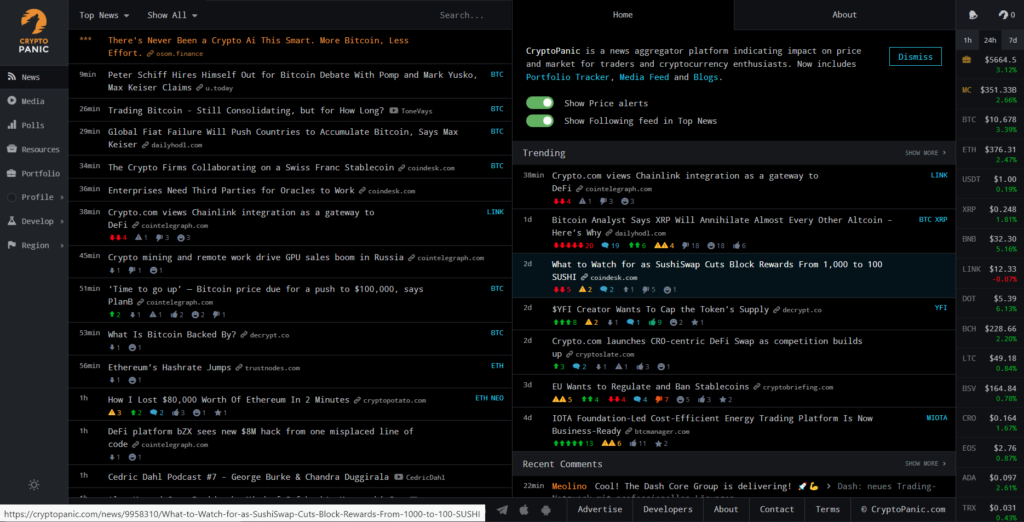

Cryptopanic – News aggregator

Crypto panic is essential for altcoin bag holders, it allows you to keep abreast of all the latest news and events for only the coins that interest you using their ‘follow’ & ‘follow feed’ feature, using this you can search for projects then follow them. once you have followed all the projects you are interested in you can use the follow feed to keep up with all the latest from your favorite projects aggregated from across the web. It also allows you to sort and filter posts in a large variety of different ways.

Messarii – Market leader-board

Messari is the most feature-rich market leaderboard, its another highly customizable data source. To get the most out of messari a pro account is required but is is very feature-rich for free accounts.

Datamish – Bitmex sentiment

Datamish provides long v short data from Bitmex in a quick view, dash style format much like scalpex. What sets it apart is the larger selection of currencies but lower fidelity information about them.

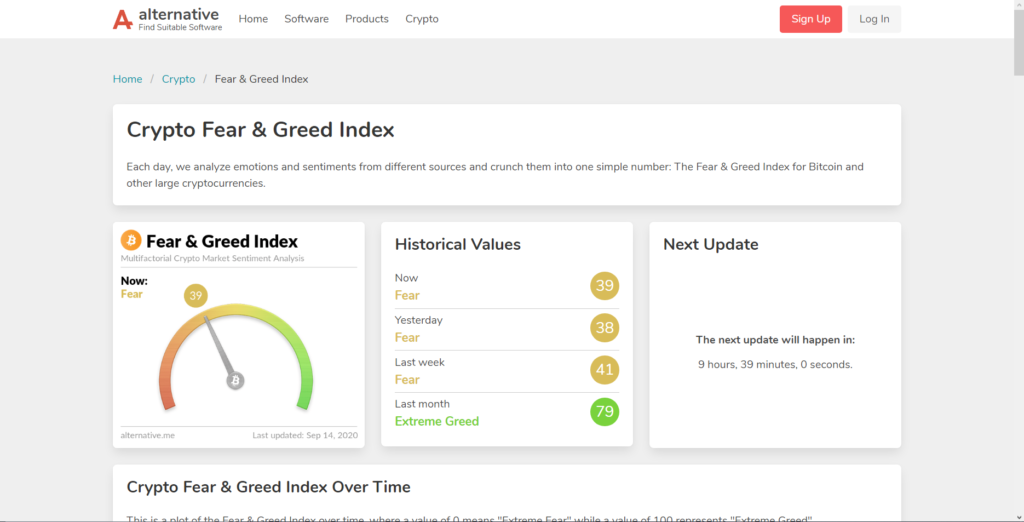

Crypto fear and greed index – Fear and greed indicators

The crypto fear and greed indicator combines social and on-chain metrics as well as exchange data to produce a single value representing the overall fear, neutrality or greed in the market. It also allows you to see a historical graph of previous fear and greed values.

Coin 360 – Market leaderboard

Coin 360 is the quickest way to see market movements of the top coins all at once. It has an extremely simple interface using a grid of squares to represent crypto projects with the size of each square being in proportion to market cap, with its default settings. It updates live and is great if you only have time to glance at the markets as a whole.

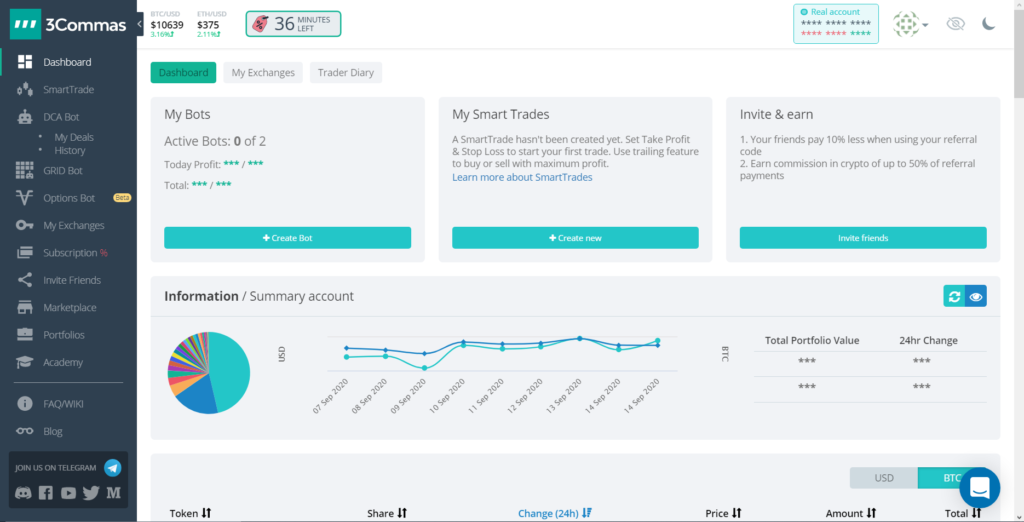

3Commas – Portfolio & automated trading

Without a subscription 3 commas is just a portfolio tracker. But if you sign up to their platform you can use it to execute many different kinds of automatic trades. Using it you can sell-off entire accounts into bitcoin or stables coins with the click of a button. The platform has an automated DCA system. It can also be used to trade all of your accounts in one place, so instead of having to log into multiple exchanges to transfer funds or make a trade you can use their web interface to do it all. If you can justify the subscription fees this is the ultimate crypto portfolio tool.

Recap – Automated crypto taxes

Recap uses zero-knowledge encryption to handle your api data, it is a secure, easy and fully compliant with UK taxes with other jurisdictions coming soon. If you are in the US i recommend tax-bit.

DYOR – Do your own research

Nobody can tell you what is a good investment for you, albeit some are easy wins that anyone can profit from but being successful at trading requires method and discipline not luck or opportunity.

I can however outline where to get information for the various kinds of research you might want to do. for example if you are looking for altcoin gems then scalpex is the wrong website, you want to be looking at reddit for talk of upcoming or interesting projects, as well as using a market screener like Mesari or coin gecko to find low-cap projects. From there you must read the information that’s rigorous google searching provides about each project you have found, and check out its git or public repo if it has one. If after all that the project seems genuine, interesting and forward thinking to you then these are good signs of a project that will moon.

If you are looking to take a futures position in bitcoin however then skew and scalpex are the places to go. When looking at indicators such a sentiment or social indices remember the majority (majority – as in retail-traders) are usually wrong. Researching a futures position is a completely different endeavor to spot altcoin trading. And is to cover it in a paragraph would be to over simplify.

But briefly, you need to take into account how long you can fund the position along with the time-frame of the trade, this being when you think you will be out, 1 hr, 1 day?. The risk of the trade, this is potential gains weighed against potential losses, another way to put it is, is there a good chance the price is going to move higher than it will move lower. This can be evaluated with indicators, price channels, sentiment flips and more. But risk is more than just that, it comes into how much leverage you use, very little, less than 5x is sensible, 10x is extremely confident, any more is stupid. You also need to keep abreast of the news for the base and quote whatever ticker you are trading for potential dump or (rarely) pump events. That doesn’t mean watching the news like a hawk, but more set aside just 30 mins a day to look at a good news aggregator, crypto panic might not e best suited if you want to track just the base and quote of one ticker.

If some of these terms have gone over your head please google them along with a relevant keyword like, trading, or crypto. Or leave a comment and we will get back to you.

Have you got any more useful apps or websites? Let us know in the comments and we will try to include it in the next installment of ‘How to DYOR’